closed end fund liquidity risk

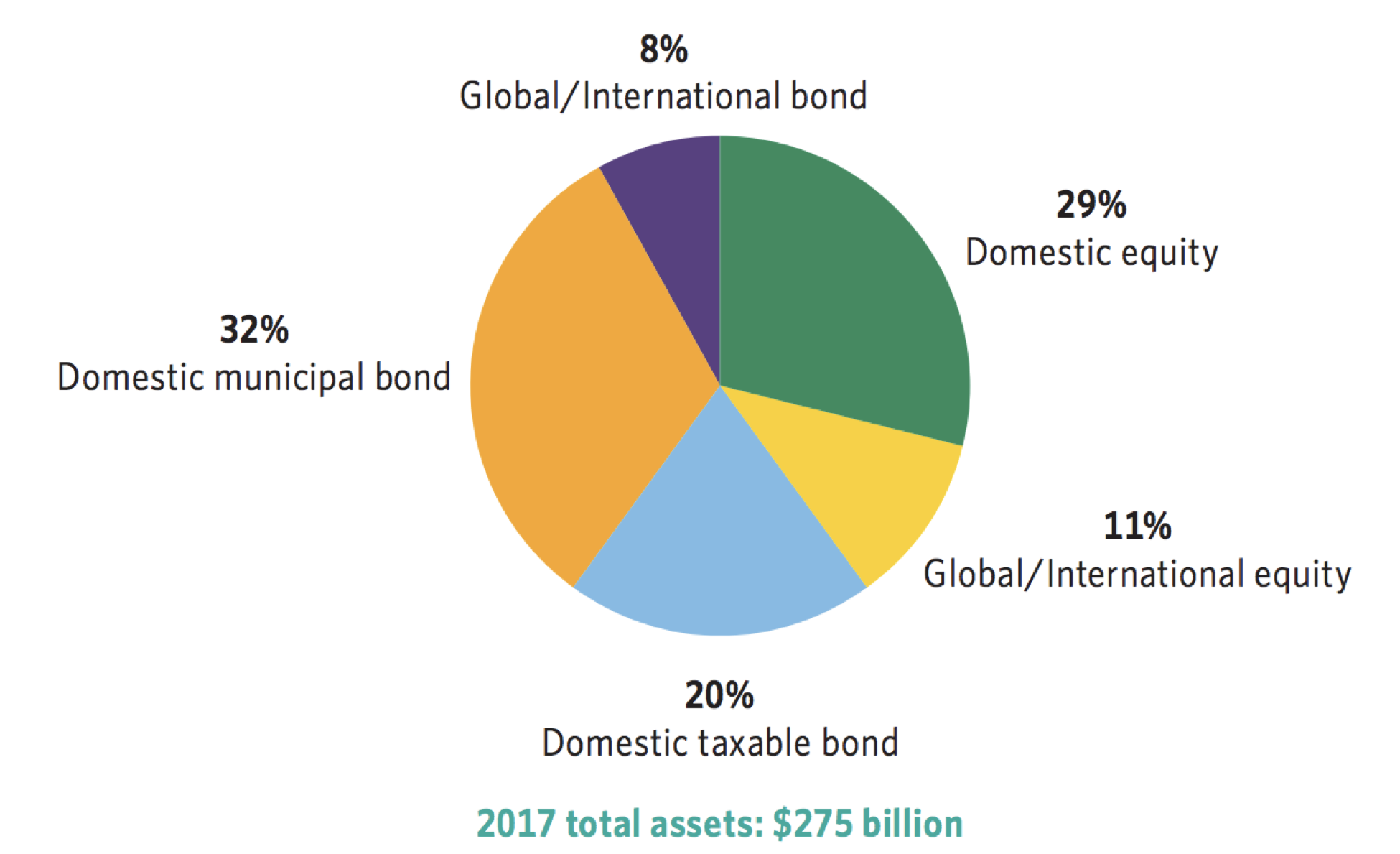

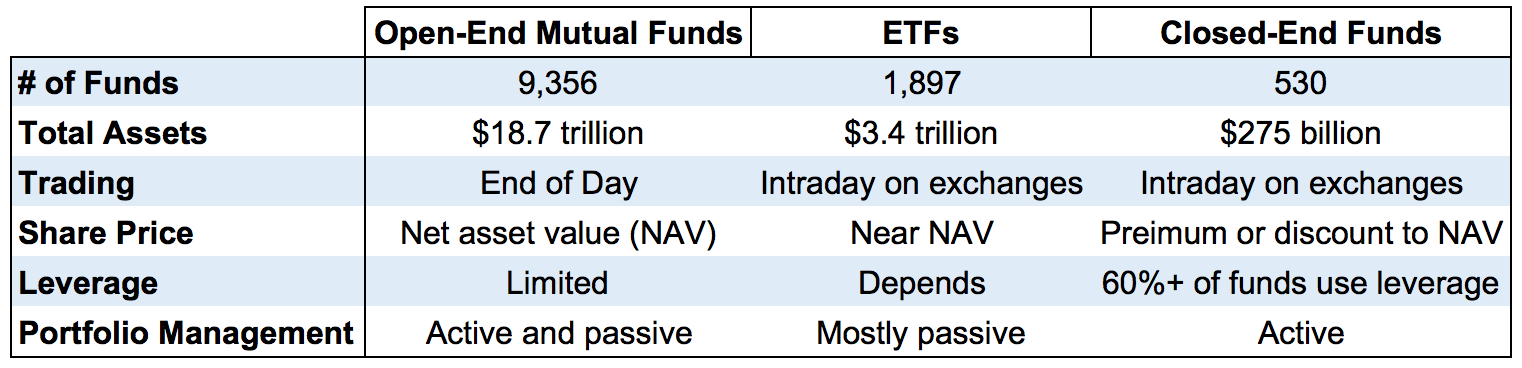

The Closed-end funds CEFs sector is a small but diverse subset of investment products that has recently seen an increase in popularity. Lets assume that the market price is 18 per share and that NAV is 20.

What Is The Difference Between Closed And Open Ended Funds Quora

Open An Account Today.

. A closed-end fund is a type of investment company whose shares are traded on a stock exchange or in the over-the-counter market. Many of the newer funds have also seen a. Questions may be directed to the.

How this fund has thrived as the market tanked. The use of leverage allows a closed-end fund to raise additional capital which it can use to purchase more assets for its portfolio. The use of leverage by a closed-end fund.

A closed-end fund or CEF is an investment company that is managed by an investment firm. Like a mutual fund a closed-end. The value of a CEF can decrease due to movements in the overall financial markets.

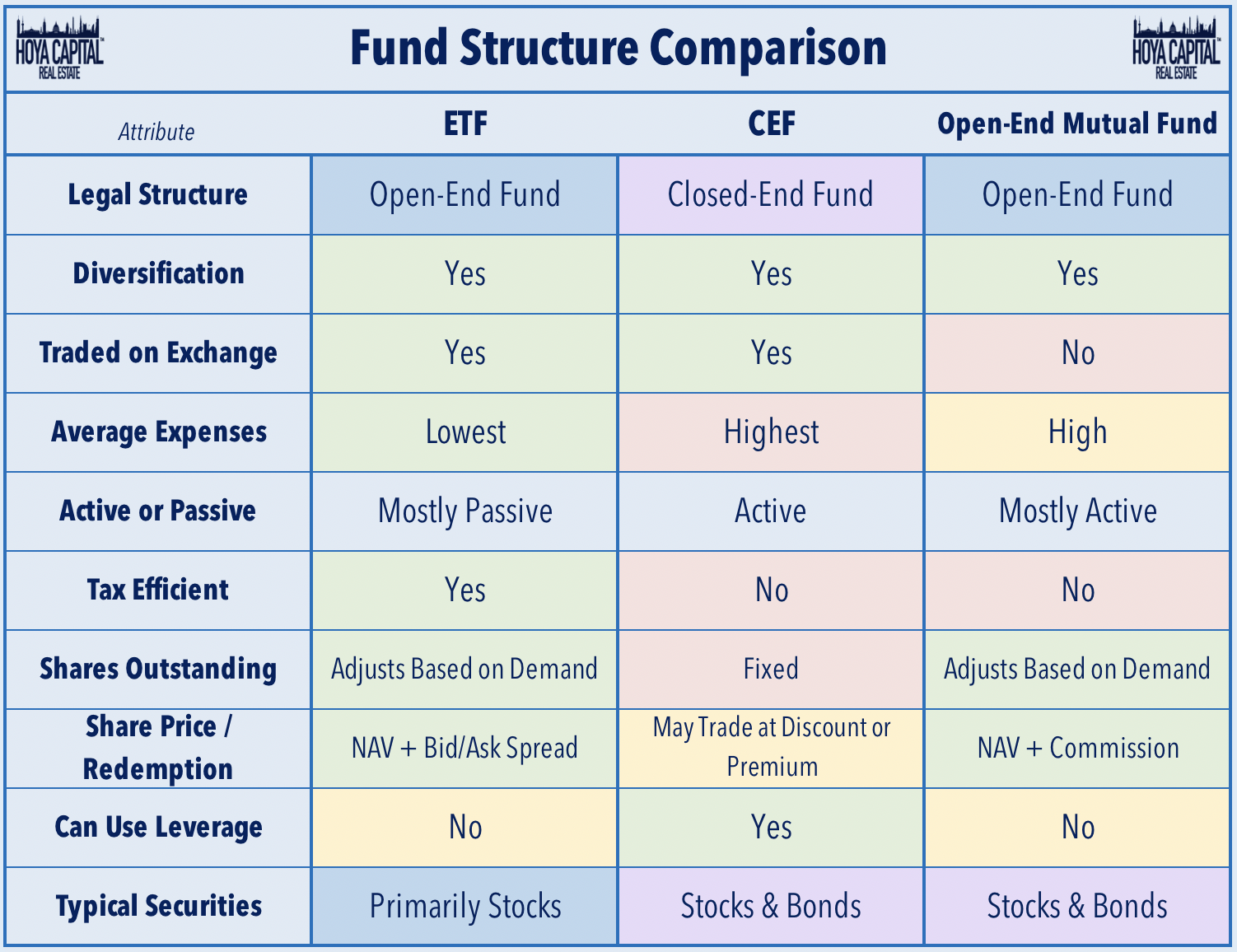

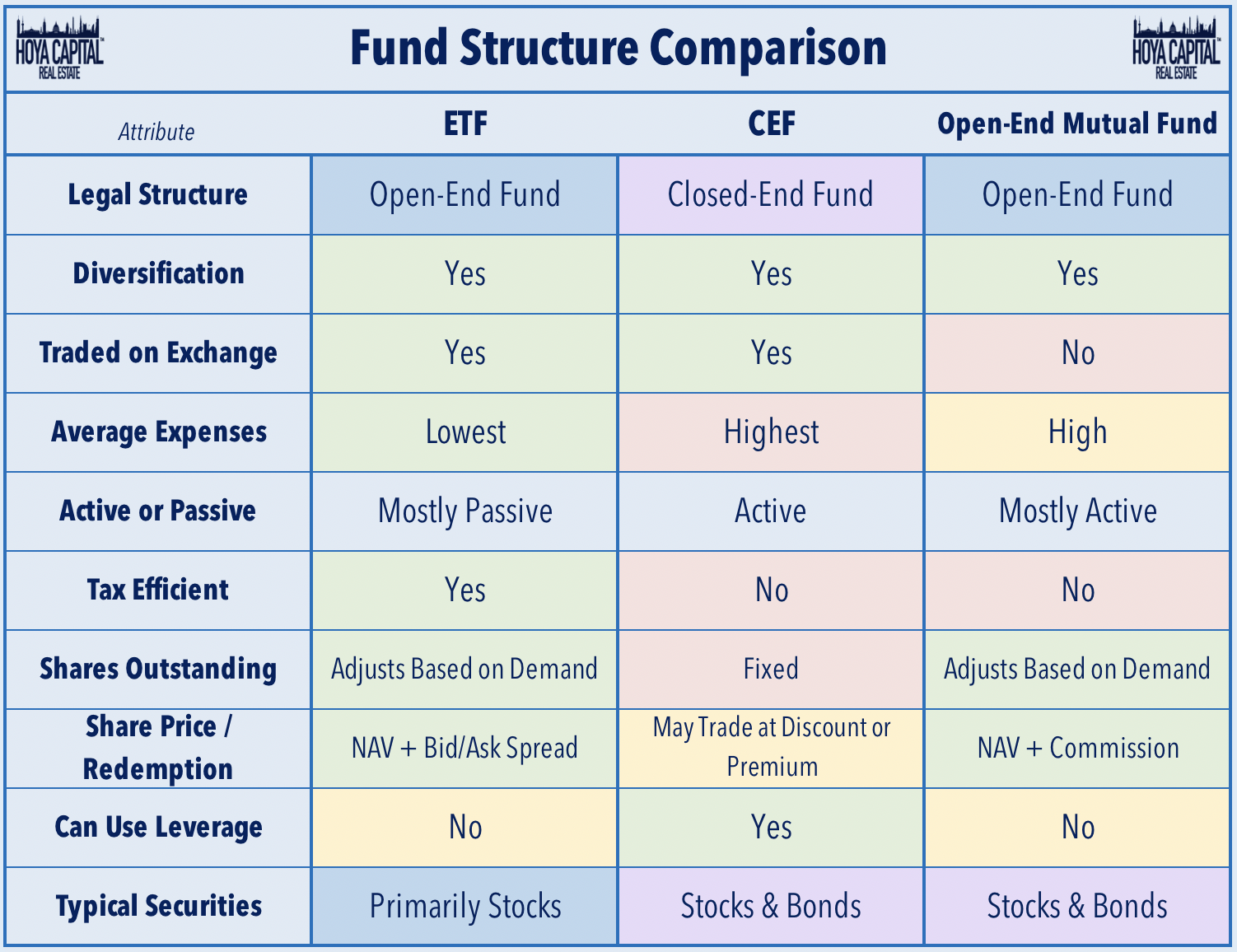

In this case the closed-end fund sells at a discount of 2 per share. 1 day agoNEW YORK June 14 2022 PRNewswire -- MainStay CBRE Global Infrastructure Megatrends Closed-End Fund the Fund NYSE. Closed-end funds are investment vehicles that bear a passing resemblance to mutual funds and exchange-traded funds ETFs.

Any day when theres a 1 move in a CEF can be thought of as a day when there is a supply and demand imbalance outside of ex-dividend days and large moves in interest. Learn more about what it is and how it differs. MEGI has announced the sources of its.

Learn why over 370K members have invested over 25 billion with Yieldstreet. They are retired when an investor sells them back. Ad Another Bear Market Another Positive Return For This Fund.

With a Focus on Client Goals American Funds Takes a Different Approach to Investing. Additionally while a money market fund is an open-end management investment company money market funds are not subject to the rules and amendments we are adopting except. Additionally we find that the higher the liquidity risk of a closed-end fund relative to its underlying portfolio the larger the closed-end fund discount market price of the closed end fund is.

Mutual funds are open-end funds. Ad Learn More About American Funds Objective-Based Approach to Investing. The paper is organized as follows.

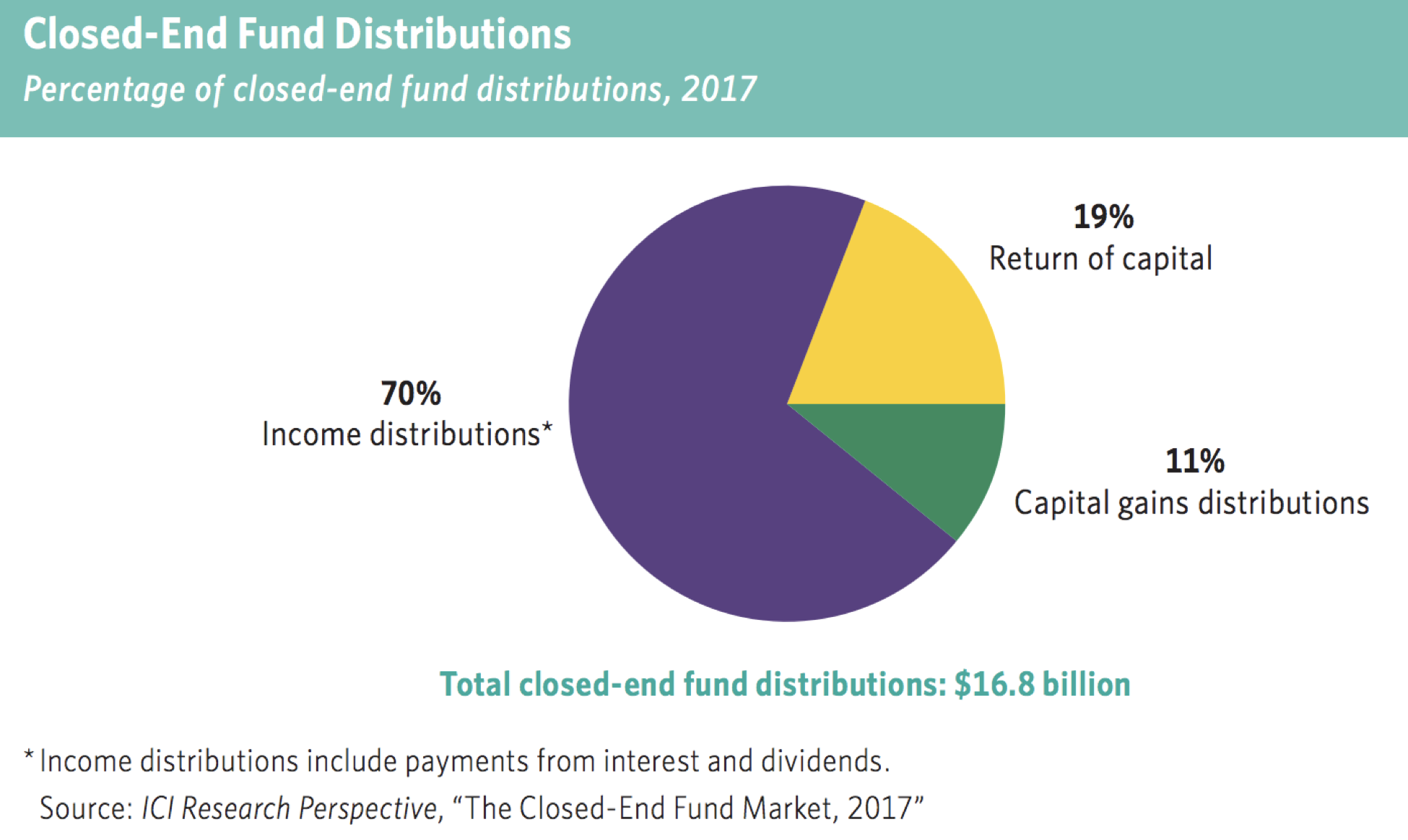

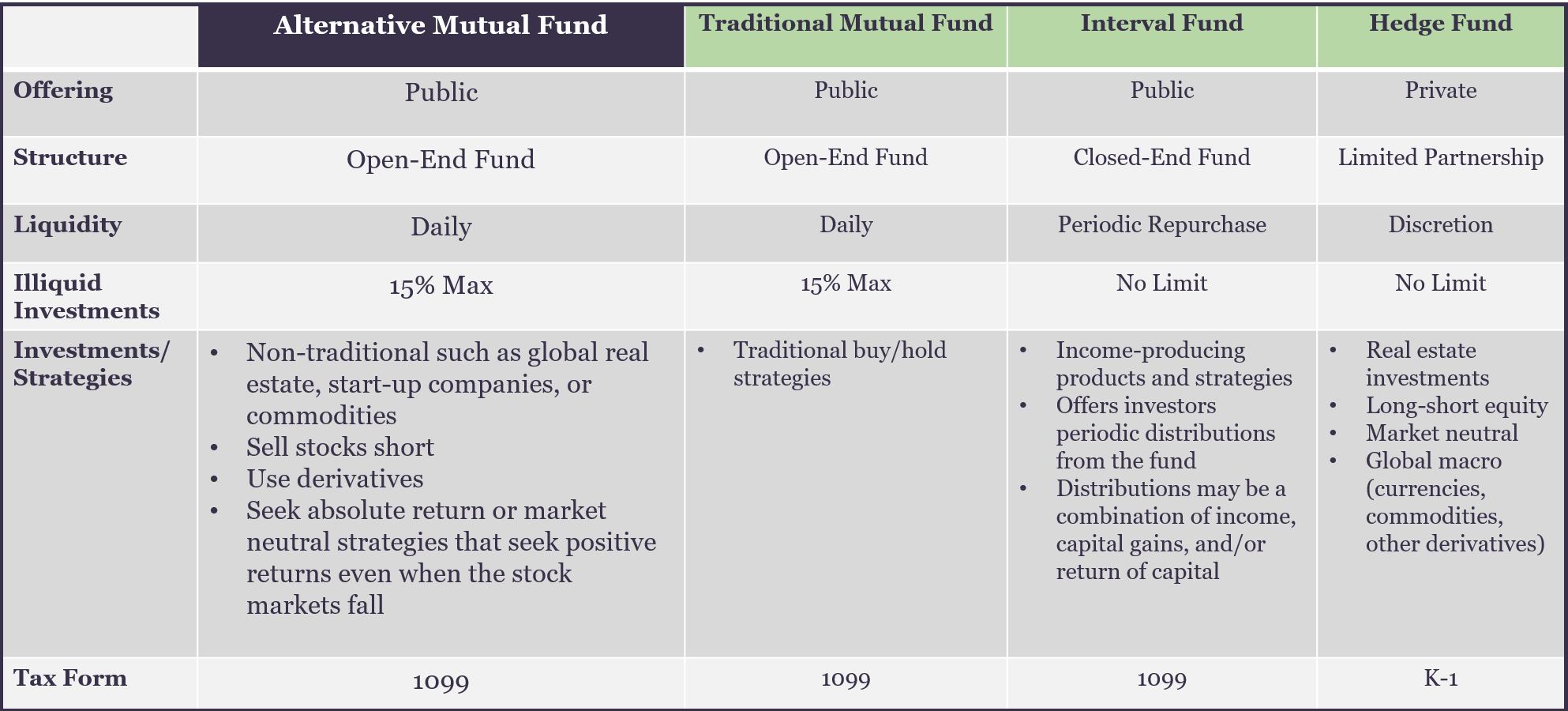

Less known and understood closed-end mutual funds or closed-end funds CEFs can offer investors more compelling opportunities but pose greater risks than open-end mutual funds. CEFs are sometimes described as ancestors to exchange-traded funds but CEFs have a fixed number of shares while ETFs can raise or lower the figure as demand changes. A CEF or a closed-end fund is an investment fund that raises money through an IPO and then sells shares on the open market.

Section 3 motivates the model discussing the interaction between. A closed-end fund is organized as a publicly traded investment company by the Securities and Exchange Commission SEC. When investing in closed-end funds financial professionals and their investors should first consider the individuals.

Manzler 2004 shows that the discounts on closed-end funds are driven by. How this fund has thrived as the market tanked. Closed-end funds raise a certain amount of money.

Just like open-ended funds closed-end funds are subject to market movements and volatility. Non-listed closed-end funds and business development companies do not offer investors daily liquidity but rather offer liquidity on a monthly quarterly or semi-annual basis often on a small. Its assets are actively managed by the funds.

Ad Generate returns with typically low correlations to traditional markets starting at 500. New shares are created whenever an investor buys them. Liquidity risk management program rule1 demand for asset classes that are not suitable for.

The SECs Division of Investment Management is happy to assist small entities with questions regarding the liquidity risk management rules. Ad Another Bear Market Another Positive Return For This Fund. All three fund types are pooled.

Ad Choose From Hundreds Of No Transaction Fee Mutual Funds. This is a significant risk for closed end bond funds as a default by one or more of the CEFs underlying bond holdings can have a significant impact on the CEFs NAV market price and. Unlisted closed-end funds also provide limited liquidity.

Closed-end funds can offer advisers opportunities to introduce clients to successful portfolio managers and strategies at a discount when prices fall. On a percentage basis the fund sells at a discount. Closed-end fund definition.

Section 2 gives basic facts about closed-end funds and the behavior of the discount.

Closed End Funds Basics How It Works Pros Cons The Smart Investor

Closed End Fund Definition Examples How It Works

5 Reasons To Use Closed End Funds In Your Portfolio Blackrock

What Is The Difference Between Closed And Open Ended Funds Quora

Closed End Fund Fs Investments

Open Ended Mutual Fund Vs Close Ended Mutual Fund What To Prefer

Difference Between Open Ended And Closed Ended Mutual Funds Differbetween

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Closed Vs Open Ended Funds Which One Do I Pick Mutual Funds Etfs Trading Q A By Zerodha All Your Queries On Trading And Markets Answered

Real Estate Cefs Satisfying A High Yield Fix Seeking Alpha

The Problem With Open Ended Life Settlement Funds Articles Advisor Perspectives

Investing In Closed End Funds Nuveen

Closed End Funds Basics How It Works Pros Cons The Smart Investor

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Alternative Mutual Fund Liquidity Spectrum Investment Comparison

What Is The Difference Between Closed And Open Ended Funds Quora

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends